Lets run through the cash flow of a business… the meanings, the confusing and the cold hard truth.

At The Serial Seller, we are not accountants but we can help with cashflow due to our business structuring and sales processes.

Running your own business comes with a wide variety of challenges, but one of the biggest is managing cash flow, the lifeblood of the company. Yet businesses often underestimate its importance, instead thinking that as long as they are busy then their business will survive and grow. However with regular outgoings such as wages, rent, stock and utilities to pay, without adequate revenue and cash flow their businesses may stagnate and fail.

We’ve all heard the saying, “Cash is King.”

While the words may be cliché, they’re also true — particularly for small business. Without a cushy safety net or direct line to a big bank’s lending department, survival often hinges on your ability to effectively manage the delicate balance of cash in and cash out.

When there’s no cash on hand, everything is tough. You need to understand your cash position. Paying salaries, paying bills, buying supplies, not to mention making the investments needed to grow to the next level.

Profit and Cash Flow Are Not The Same

This is a common mistake small business owners make when they first enter the world of accounting and bookkeeping. So what’s the difference between the two?

Profit, also known as net income, is your business’ revenue less the expenses. In the other words, your net income is what you actually get to keep after covering all of your business expenses.

In contrast, cash flow refers to the cash inflows and cash outflows for your business.

Cash Inflow & Cash Outflow

Cash inflow is the lifeblood of your business and comes from sources like payments from customers, receipt of a loan, monetary infusion from an investor, or interest on savings or investments.

Cash inflow is really where we at The Serial Seller can come in handy for your business.

Cash is also important because it later becomes the payment for things that make your business run: operating expenses like stock or raw materials, employees, rent, and other operating expenses. Naturally, positive cash flow is preferred. Positive cash flow means your business is running smoothly. High positive cash flow is even better and will allow you to make new investments (hire employees, open another location) and further grow your business. We love that, right!?! Conversely, there’s negative cash flow: more money paying out than is coming in.

Get Organized and Plan

Positive cash flow is driven by two things: organization and planning.

Organizing

Let’s start with setting your baseline. Begin by looking at the cash you have in hand, this could be money you’ve invested in the business, cash in the business bank account, loans that you’ve received, or an investment from a partner.

If you’re just starting your business, your interest in cash flow is well-timed. Make a list of all the one-time start-up expenses that you have paid or expect to pay. Think incorporation fees, legal and accounting, licenses and permits, construction or remodeling, a security deposit on a rental agreement or purchasing property, marketing materials, and signage, initial inventory or supplies, fixtures like cash registers, office supplies, furniture, equipment, etc.

Planning

Next, you want to determine your monthly expected cash sources. These can be projected sales, loans that you know are coming in at a certain date, investments from partners or investments. If you’re a new business you might want to project sales conservatively (better to outperform and have a better inflow of cash than you thought). If you’ve already started your business or are purchasing a business from someone else, you have a distinct advantage: sales history. History can’t predict the future, but it can paint a decent picture of what the future looks like and what business changes you might need to make.

Finally, you will need to assess your monthly expenses. This can be a bit tricky because it’s easy to overlook things and get a surprise you really don’t want. Monthly expenses to factor in can include rent or mortgage, insurance, advertising, marketing, website hosting, travel, utilities, payroll, inventory, taxes, loan payments, working capital, and last but not least paying yourself!

The most important thing about this process is being honest and objective. Do your homework and get accurate estimates of costs. If costs look high, simply projecting more sales when you don’t have the capacity to close those sales won’t fill that proverbial water tank. So perhaps you tighten the outflow. What can you reduce or cut? For example, if you’re launching a boutique, maybe you rent that 500-square-foot space instead of the open, airy 1,000-square-foot one. Or maybe you initially limit the amount of merchandise you buy. (Added bonus: if the merch is in high demand, you’ve not got scarcity on your side!)

Set Up A Cash Flow Statement

Set up a statement of cash flows

A cash flow statement can be one of the most important tools in managing your finances. Use our cash flow statement template to help plan your business payments.

Why you need a cash flow statement

A cash flow statement tracks all the money flowing in and out of your business. You can use your cash flow statement to:

- Find payment cycles and seasonal trends

- Forecast your future business finances

- Help predict shortages and surpluses

- Plan ahead to make sure you always have money to cover payments.

Cash flow forecasting

A cash flow forecast is an estimate of your future sales and expenses. It is a useful tool to help you understand if you will have enough income to cover your expenses. This will help you prevent cash shortages and avoid debt.

You can use the cash flow statement template to create a cash flow forecast by entering your estimated figures for each future period.

What you Need To Know bout Cash Flow

Cash flow management

Cash flow management is essential for the success of any business. Good cash flow management allows businesses to maintain their current activities, invest in new opportunities, pay its bills on time and make more profit.

It involves monitoring the money coming in and out of a business, understanding the sources and uses of money, managing expenses, and ensuring that customers pay on time. With good cash flow management practices a business can navigate financial hardships, remain financially healthy, and create wealth over time.

Financial statements

Financial statements are a valuable tool for businesses to assess their financial performance over time. They provide insight into key metrics, such as total revenues, costs, and net income. These statements also allow businesses to compare themselves to other companies in their industry, so they can better understand how they are performing relative to their competitors.

Additionally, investors use financial statements as a means of assessing the potential profitability of a business, before investing in it. By evaluating all elements within financial statements and analyzing trends over time, businesses have the capacity to make decisions that will result in long-term success.

Cash Balance

Cash balance is used to measure financial performance. It is an important tool for businesses as it provides a clear snapshot of their current financial situation and any potential risks or opportunities.

For example, if a company’s cash balance is low in comparison to other companies in the same industry, it may indicate that there could be financial difficulties. By keeping track of their own cash balance, businesses can take steps to improve their cash reserves and minimize these risks.

Payment Options

Payment options refer to the different methods available to customers when they are making a purchase. Payment options can include traditional credit card payments, e-payments, mobile payments, contactless payment methods, and more.

It is important for businesses to offer various payment options so customers have flexibility when it comes to making purchases. Offering multiple payment methods also encourages customer loyalty and boosts business revenue as customers often select purchase options based on convenience.

Furthermore, businesses have the opportunity to build trust with their customers by offering secure and reliable payment solutions that provide safety and peace of mind every time they make a purchase.

Income Statement

An income statement, also known as a profit and loss statement or statement of financial performance, is a document that summarizes the revenues, costs, and expenses incurred during a specific period of time. It reports a company’s total revenue, expenses, and profits or losses over a specific accounting period.

This helps businesses evaluate their financial performance to ensure that their profits are maximized or losses are minimized. The income statement report often plays an important role when it comes to tax obligations and in-depth business analysis for investors and lenders.

Cash Flow Analysis

Cash flow analysis is an important aspect of personal and business finance. It looks at the cash inflows and outflows over a period of time to determine how much money is entering and leaving the organization, either businesses or individuals.

A genuine cash flow analysis provides a clear view of what’s happening with cash now, as well as a complete understanding of expected trends. This information can help individuals make smart financial decisions such as when to acquire new assets, fund operations, or offset liabilities. Likewise, businesses use this data to understand how their current operations are impacting overall financial health, and how best to manage working capital or raise additional capital.

Cash flow analysis helps gauge whether funds need to be sourced from external sources or can be managed internally while taking into account potential investment opportunities available in the market.

A Cash flow analysis can help you keep better track of overall cash flow through cash flow reports which can show, cash flow issues, steady cash flows, actual cash flows, cash flow projections, any extra cash, and overall effective cash flow management.

Seven Ways to Improve your Business Cash Flow

Maintain updated cash flow forecasts

Based on your previous sales, create and maintain a forecast of the likely peaks and troughs in your sales and expenditure. By predicting your expected expenditure such as rent, wages, equipment and taxes against your expected incoming cash from sales, you will be able to identify when your business will need additional capital. Online accounting tools such as Xero and QuickBooks can help prepare these forecasts automatically, allowing you to effectively monitor and better manage your cash flow in real time.

Calculating Your Operating Cash Flow Margin

The Operating Cash Flow Margin (also called the Cash Flow Margin, or Margin Ratio), is one of the most commonly used profitability ratios. It’s a measure of how much money you are generating from your operations per every dollar in sales you bring in. Generally the higher the Operating Cash Flow Margin the better and if this ratio increases over a period of time, it’s an indication that your business is getting better and better at converting earnings from sales into cash flow!

The formula for calculating this number is:

Operating Cash Flow Margin = Cash Flow from Operations / Net Sales

Streamline invoicing

Postponing the creation and sending of invoices, in favor of focusing on more immediate business priorities, has a direct negative impact on Days Sales Outstanding (DSO), meaning it will take longer to collect your receivables. This issue is exacerbated if you still rely on sending invoices in hardcopy, which can take many days to arrive and further delay receipt of payment. Your business misses the opportunity to leverage and potentially reinvest revenue earned, which would generate greater value for your business. There are invoicing apps to tackle these challenges such as Invoice2go, which creates and sends invoices to your customers by email with just a few clicks. These e-invoices also include a payment button, meaning your customers can easily pay by card just by clicking a link.

Define your payment terms

When you issue an invoice, ensure that your payment terms are clearly communicated. Should a customer fail to make payment by the due date, have a follow-up process in place. Solutions such as Invoice2go can also help by notifying you when customers have opened your invoice email and again when payment is overdue.

Get Paid! How to Improve Incoming Cash Flow

If you invoice customers and they have a liberal time frame in which to pay you, that can make planning tricky. However, there are ways to encourage your customers to pay their bills more quickly:

- Issue invoices promptly and follow up on them regularly. This sounds simple, but many people put off or avoid paying others simply because they don’t like parting with their money.

- Offer a discount for early payment. If your standard contract has a thirty-day term, give a small discount for payment within 10 days.

- Structure the payment with an upfront deposit or, if it’s a long project, schedule payment intervals throughout the project’s lifetime. This will ensure that you are getting some cash in the door along the way.

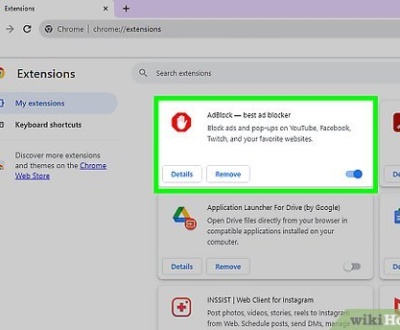

Move away from accepting cheques

The usage of cheques around the world is falling as companies and even countries realize that it is one of the most inefficient payment methods in terms of cost and speed of payment. Singapore has a government-driven initiative to make the country cheque-free by 2025. Yet some companies continue to use cheques out of habit and a lack of awareness of a suitable digital alternative. Enabling your business to accept payment by card or bank transfer will allow you to be paid faster than by cheque, improving your flow of cash and modernizing your brand perception. You can also incentivize customers to change their payment method by offering a discount, for example: “Receive a 3 percent discount on this invoice if you pay within seven days.”

Modernize your point of sale

With the growth in mobile and card payments, customers are getting used to electronic payments. This will have a growing impact on businesses that are unable to accept new payment methods. Buying a payment terminal will help address this problem, allowing you to quickly start accepting payments via credit and debit card, contactless and devices with near-field communication (NFC). With this enabled, your customers will be able to pay you faster, no longer relying on cash, whilst also saving you time, thanks to payments being settled electronically with your bank.

Paying Your Bills the Smart Way

You have to pay your bills, no two ways around it. It’s to your advantage to pay them in a timely fashion if you want to build trust with your creditors. (Plus some say it’s good karma.) But since we’re talking about outflow, we need to consider good ol’ cash flow. There are ways to pay your bills in a smart way to make sure that your cash flow remains positive:

- Use the payment term to its fullest. If you have a thirty-day term on a bill, go ahead and use the thirty days to build up the cash. That way, you’ll have a better handle on what your cash flow looks like than if you simply write a check the day you receive the invoice.

- On the flip side, see if there are discounts for paying suppliers early. (Sounds familiar, no?)

- Ask about flexible payment terms when you make a deal with a vendor. You’ll never know if you don’t ask and it could help you out in a pinch. Be cautious with this though: asking for flexible payment terms before a deal is done can raise suspicion.

- Set up ETF payments. That way you can pay immediately when a payment is due, but won’t have to let go of the funds before you’re ready.

- Build a real relationship with your vendors. If they trust you and you’re honest with them it could go a long way to making your life easier if you need to ask for an extension or accommodation.

Accept payments everywhere

In many parts of Asia when ordering online, customers prefer to see the products before paying. Cash on delivery is widely used option to address this customer need. While this option can attract new customers to your business, there are many hidden costs related to cash. Non-delivery rates are high due to the lack of cash at hand or change, cash can be lost or stolen, and manual reconciliation and settlement takes time. Implementing a mobile POS solution to accept card and mobile payments will help overcome many of the challenges that can affect negatively your cash flow.

Leverage interest-free credit

In some instances and for certain suppliers, one option available may be payment using credit cards. The financial institution that issues your credit card can provide advice on whether this is a viable option, and may provide up to 55 days interest-free credit, positively impacting your cash flow. As with all credit cards, care will be needed scheduling repayments to avoid late credit card repayment fees and interest charges. Also, consider talking to your suppliers to see whether they can provide a discount in return for early payment, helping reduce your outgoings and benefit your business.

Business Cashflow & The Serial Seller

At The Serial Seller, we are under the belief that an increase in sales and revenue is a way to improve cash flow.

The sales do need to be profitable to help with cash flow over the long term.

If you want some assistance in streamlining your organization, simplifying your sales process and increasing the amount of revenue that is brought into your business.

About us and this blog

We are a Full-Service Sales & Marketing provider that aims to help small to medium businesses increase their leads and sales while helping remove the business owners from their day-to-day activities so they can focus more on the long-term goals of their business.

Book a Meeting with us!

We offer Done-For-You Sales, Sales Coaching, and Advisory as well as Digital Marketing Services. If you want to increase the leads generated for your business and need some guidance and accountability, book a call with us now.

Subscribe to our newsletter!

More from our blog

See all postsRecent Posts

- How Do You Stop Google Ads May 9, 2025

- How to Make Money Off Social Media May 5, 2025

- How to Duplicate Page WordPress May 1, 2025