Running and managing a business is hard!

Running a small or medium business is even harder as there aren’t as many people around to support you or for you to lean on!

At the Serial Seller, we provide a framework and guided coaching on how to be successful in your business.

This comes down mostly to sales and marketing! No matter how good your product is, if you don’t have someone to sell it, it won’t sell…

Lets break down the key things you need in place when managing a business big or small.

Managing a Business A-Z

The Business Plan

Business plans are essential to running a business, regardless of the size of a business. A business plan can vary in the number of details it contains but should contain things like the history of your business, details on your logo and advertising, and the purpose of the business. It should also contain:

- A break-even analysis

- A profit-loss forecast and market research

- A cash-flow analysis and bookkeeping

- Business needs and target market (potential customers and customer base)

- Marketing plan and marketing strategy for business success

- Business goals for expansion (e.g. through social media or word of mouth)

A business plan can also help by outlining communication types, future planning, and describing how management is structured for optimal customer experience. Having a strategy for your business gives you a framework for operating with know-how and flexibility for change.

Identify Problems and Trends

Symptomatic Problems + Customer Segment= Customer Need

Understanding how to develop your problem will set you up for a better chance of success.

1. Understand the Symptoms

If you look at the above description, you can see how the first part follows the process used by physicians. When you visit the doctor, you discuss with them your symptoms. These symptoms are the outward reflections of their underlying problems. Looking at symptoms is also a natural way to think about the world around us. We typically find problems by first understanding the symptoms the problems are causing. It is these pains that make us aware of a problem.

2. Diagnose the Problem

However, the symptom (pain) is not the problem itself. It is an outcome of some underlying condition. We can see this illustrated in the example of the physician. Our symptoms help the doctor diagnose our illness or problem. We need to do the same thing when starting a new venture. We often describe the symptoms of a problem. It is your job to diagnose the problem from the visible symptoms. I suggest you carefully ask the question “Why does this symptom exist?”

3. Evaluate How the Customer Relates to the Problem

While you likely find many problems that are painful and problematic. Not all problems are worth solving entrepreneurially. They may be great needs that appear to be worth our efforts, but they do not have all of the components necessary to make an entrepreneur model successful (In these cases, we use other models — Learn More). So, what is the key difference between problems that work for entrepreneurs and those that don’t? The way you determine that a problem is a good starting point for an entrepreneur opportunity is when that problem has a clearly identified customer segment. Furthermore, is the customer segment increasing in size, does the segment have the ability to pay for a solution, and is the customer segment accessible to you? These conditions are necessary for an entrepreneur’s opportunity to be successful. Remember, you are not a customer. You may have the problem, but you need to know that customers in the market also have a relationship with the problem and meet the conditions for a problem to be solved entrepreneurial.

4. Define the Customer Need

Once we carefully match a problem with their related customer segment, we can combine them to create a definition of our customer’s need. When we talk about problems in entrepreneurship, we are really describing customer needs. It is the combination of existing problems and well-defined customer segments that make entrepreneur opportunities more likely to be successful.

Before you start working on an idea for your startup, first begin with a well-defined customer need. By doing this step first, you will improve your chances of building things people need and are willing to pay for. Don’t fall victim to building things nobody wants. Instead, start the way successful startups think about their businesses. Start with the problem.

Evaluate Problems and Trends

There is no cast-iron system for trend evaluation, but there is a set of criteria one can follow to help discern a quality forecast from a baseless guess or worse, a source with a hidden agenda. Here are five keys to unlocking trend quality:

- Understand intentions. There are dozens of ways to classify forecast materials, but the most useful way of categorizing them is by stated or implied intention, in other words, why the forecast has been made in the first place. What can be gleaned about why it exists, who put it out, or what the intention of the forecaster was? Is the forecast upfront about its purpose? All forecasting is done for benefit. By recognizing the interests at work behind a forecast, one can make a better judgment as to potential strengths and weaknesses. We may ask, what action or concerns is the forecast trying to arouse? How is it legitimating a view that the forecaster or forecast organization holds?

- Check the data is real. Data is never as solid as it seems. Among the problems are validity of definitions, validity of sampling, how research is skewed by the form of questioning, and so on. A particular problem in forecasting is that sometimes data points used in discussion are not real recorded figures but “future” data points that have been projected from past data, which raises obvious questions about how this projection has been done and how valid the process is. A good forecast will carefully distinguish real data from projected data.

- Be critical of insiders and ‘experts’. The “expert” spearheading a particular future study may not be the most intuitive thought-leader when looking at forecasts. Experts are necessary in a specialized world and expertise and credentials are important in forecasting, but experts are wrong as much as anyone. This is because a field’s experts are particularly likely to be heavily invested in the status quo, and be expert precisely in its existing procedures, attitudes, and prejudices. Change often comes from outside and experts – blinkered by their knowledge of today – are often the last to see it.

- Beware of attempts to influence the future. Forecasts fall into two main categories: future-aligning, where forecasters anticipate change in order to adapt early and successfully to it; or future-influencing, where forecasters are trying to influence events. Future-aligning approaches aim to be objective. They may fail, but the intention is there, so, on balance, this approach will be more accurate. Future-influencing forecasts aim to succeed on other terms – alerting and shaping opinion, changing minds, and harnessing action. Forecasts that are trying to lobby or change industry conditions make themselves known by seeking publicity, and often being a forecast of extreme optimistic or pessimistic outcomes (to be aspired to or negated).

- Consider blocking forces. All drivers of change work against the frictional resistance of the status quo—the systems and solutions that people are currently invested in and comfortable with. They also face direct ‘blockers’ and ‘turners,’ which are forces that have a vested interest in the status quo and don’t want to see change, or that have an interest in another type of change. A good forecast will assess the strength of resistance to change and anticipate specifically if and how this resistance will be overcome, if indeed it will be, and account for the resources required to achieve this. Rather than running with the breathless wow-of-the-new, the forecast will display a measured pragmatism in the face of constraints, and adjust the forecast direction and/or timing accordingly.

Select Problem to Focus on

The main advantage of focusing on better understanding the problem is that the more time we invest in it, the easier it will be to find a solution and there are good chances that this solution will be simpler and faster to implement than the first solution we thought of.

Pinpoint Pain Points and Determine Jobs to Be Done

What Are Customer Pain Points?

A pain point is a specific problem that prospective customers of your business are experiencing. In other words, you can think of pain points as problems, plain and simple.

Like any problem, customer pain points are as diverse and varied as your prospective customers themselves. However, not all prospects will be aware of the pain point they’re experiencing, which can make marketing to these individuals difficult as you effectively have to help your prospects realize they have a problem and convince them that your product or service will help solve it.

Although you can think of pain points as simple problems, they’re often grouped into several broader categories. Here are the four main types of pain points:

- Financial Pain Points: Your prospects are spending too much money on their current provider/solution/products and want to reduce their spend

- Productivity Pain Points: Your prospects are wasting too much time using their current provider/solution/products or want to use their time more efficiently

- Process Pain Points: Your prospects want to improve internal processes, such as assigning leads to sales reps or nurturing lower-priority leads

- Support Pain Points: Your prospects aren’t receiving the support they need at critical stages of the customer journey or sales process

Viewing customer pain points in these categories allows you to start thinking about how to position your company or product as a solution to your prospects’ problems, and what is needed to keep them happy. For example, if your prospects’ pain points are primarily financial, you could highlight the features of your product within the context of a lower monthly subscription plan, or emphasize the increased ROI your satisfied customers experience after becoming a client.

However, while this method of categorization is a good start, it’s not as simple as identifying price as a pain point before pointing out that your product or service is cheaper than the competition. Many prospective customers’ problems are layered and complex, and may combine issues from several of our categories above. That’s why you need to view your customers’ pain points holistically, and present your company as a solution to not just one particularly problematic pain point, but as a trusted partner that can help solve a variety of problems.

How Do I Identify My Customers’ Pain Points?

Now that we know what pain points are, we need to figure out how to actually identify them.

Although many of your prospects are likely experiencing the same or similar pain points, the root cause of these pain points can be as diverse as your clientele. That’s why qualitative research is a fundamental part of identifying customer pain points.

The reason you need to conduct qualitative research (which focuses on detailed, individualized responses to open-ended questions) as opposed to quantitative research (which favors standardized questions and representative, statistically significant sample sizes) is because your customers’ pain points are highly subjective. Even if two customers have exactly the same problem, the underlying causes of that problem could differ greatly from one customer to another.

There are two primary sources of the information you need to identify your customers’ pain points – your customers themselves, and your sales and support teams. Let’s take a look at how to get the information you need from your customers first.

Regardless of what’s causing the pain, you now have a pain point you can counter in your marketing. Remember our list of pain points from earlier in this post? Let’s take a look at the pain points we identified, and see how we could address them in our marketing:

- Financial: Emphasize lower price point (if applicable), highlight the average savings of your client base, use language that reiterates better ROI

- Productivity: Highlight reductions in wasted time experienced by current customers, emphasize ease-of-use features (such as at-a-glance overviews or a centralized dashboard)

- Processes: Mention current/planned integrations with existing products/services (i.e. Slack’s integration with Dropbox and Salesforce), highlight how your product/service can make typically difficult/time-intensive tasks easier

- Support: Help the prospect feel like a partner by highlighting your after-market support, use connecting language (“us,” “we” etc.) in your copy

It’s important to remember that you can’t “prove” you can ease your prospects’ pain, and what works for one customer may not work for another. That’s what makes social validation so crucial when using customer pain points in your marketing; word-of-mouth recommendations and user reviews become much more persuasive when a prospect already believes your product or service could make their life better.

Define Overall Vision, Mission, and Core Values

Mission, vision and values statements serve as the foundation for an organization’s strategic plan. They convey the purpose, direction and underlying values of the organization. When developed and implemented in a thoughtful and deliberate manner, these statements can serve as powerful tools that provide organizations with meaningful guidance, especially under times of rapid change. Consequently, taking the time to craft relevant mission, vision and value statements should be carefully considered.

Mission Statements

The mission statement defines an organization’s purpose or reason for being. It guides the day-to-day operations of the organization, communicates to external stakeholders the core solutions the organization provides in society and motivates employees toward a common near-to-medium term goal. In short, the mission statement paints a picture of who the company is and what the company does.

A good mission statement should only focus on what is most important to the organization. It should be brief, clear, informative, simple and direct. It should avoid elaborate language, clichés, and generalizations and it should emphasize outcomes and the people the organization is serving.

When writing a mission statement, consider the following questions:

- What do we do today?

- Who do we serve?

- What are we trying to accomplish?

- What impact do we want to achieve?

Vision Statements

The vision statement describes the future of the organization. It reveals what the company aspires to be or hopes to achieve in the long-term. The vision statement is inspirational and motivational but also provides direction, mapping out where the organization is headed. In this regard, it serves as a guide for choosing current and future courses of action.

An effective vision statement should be concise, unambiguous, futuristic, realistic, aspirational and inspirational. It shouldn’t be generic but rather focus on outcomes specific to the organization.

When writing a vision statement, consider these questions:

- Where are we going moving forward?

- What do we want to achieve in the future?

- What kind of future society do we envision?

Values Statements

The values statement highlights an organization’s core principles and philosophical ideals. It is used to both inform and guide the decisions and behaviors of the people inside the organization and signal to external stakeholders what’s important to the company. An organization’s core values shape daily culture and establish standards of conduct against which actions and decisions can be assessed.

A values statement should be memorable, actionable and timeless. The format of the values statement depends on the organizations; some organizations use one, two or three words to describe their core values while others provide a short phrase.

When drafting a values statement, some questions to consider include:

- What do we stand for?

- What behaviors do we value over all else?

- How will we conduct our activities to achieve our mission and vision?

- How do we treat members of our own organization and community?

Assemble Focus Group and Follow “Lean Startup” Loop Until Achieving “Customer Validation”

The Four Pillars of Lean Startup

The Four Pillars of the Lean Startup method are:

Build-Measure-Learn

Quickly build something that you can try out on potential customers; measure its acceptability and value to its intended audience and learn from what you’ve measured

Build a Minimum Viable Product

Build something that’s good enough to try on customers, no frills, probably not much error recovery. Build it quick and fast; get it out to early adopters; think big; start small

Conduct an Experiment and Collect Relevant Metrics

Create a hypothesis about the product or market; create experiment(s) to try out your hypothesis; measure the experiment’s outcome to validate or disprove hypothesis.

A key part of this measurement is what the method calls Innovation Accounting, which focuses on how entrepreneurs can maintain accountability and maximize outcomes by measuring progress, planning milestones, and prioritizing. This is different from traditional accounting.

Another key part is Validated Learning. This is defined as a process in which one learns by trying out an initial idea and then measuring it to validate its effect. Each test of an idea is a single iteration in a larger process of many iterations whereby something is learnt and then applied to succeeding tests.

Persevere or Pivot

Find the sweet spot of your product. Your metrics will tell you if you should keep going with your original idea or “pivot” and turn in a different direction.

Build Financial Model

What is a Financial Model?

A financial model represents a business’s past, present, and future operations, and it’s a must in almost every business plan.

It’s a type of business report that relies on accounting. It’s important to have a solid understanding of basic accounting for business transactions when building one.

Understanding the building, using, and modifying of these models is a must.

Knowing how to build a financial model is a needed skill for those starting new businesses, starting new lines of business within existing companies, or assessing financial performance within a new or existing business.

Benefits of Building a Financial Model

When you build a financial model, you’re representing a real-life situation with numbers so that decision-makers can make improved financial decisions.

If a financial problem in the real world needs to be solved, analyzed, or translated into an easy-to-digest numerical representation, a financial model is a big help.

Sometimes it’s just a concept or idea that needs translating into an easy-to-understand proposal or use-case.

For instance, how can you convey the depreciation on a piece of equipment?

Or explain a free cash flow sensitivity analysis?

These models help you build working business plans that help with budgeting, financial planning, and more.

Once you become adept at financial modeling, you can help others understand the grandest of concepts, from the cost of goods sold (COGS) and corporate finance to investment banking and private equity.

You’ll help put actual meaning into business ideas as you supplement details that officers can use to make decisions, garner investors, or hire staff.

As an example, financial models help investors choose which projects are worth their time and money. Models help executives discern the most plausible marketing campaigns having the highest ROI. They also help production managers choose when and if purchasing new equipment is right for the company.

How to Build a Financial Model in 6 Steps

Knowing how to build a financial model is a must for financial officers, investors, and others involved in the financial operations of a business or organization.

Here are the six basic steps for building a financial model:

1. Gather historical data. You’ll need at least the last three years of financial data for the company.

2. Calculate ratios and metrics. Using the historical data from the first step, you’ll calculate historical ratios and metrics, like growth margins and rates, asset turnover ratios, and inventory changes.

3. Make informed assumptions. Armed with your historical data, ratios, and metrics, continue using this information to build future ratio and metric projections. Use assumptions to calculate future growth margins and rates, assets that may turnover, and projected changes in inventory.

4. Create a forecast. Use all the above data and reports to forecast the usual accounting documents, such as future income, balance sheet, and cash flow statements. Do this by reversing your original calculations for historic ratios and metrics. Specifically, use your previous assumptions to build out the forecasted statements.

5. Value the company. After you’ve forecasted, you can now value the company using the DCF, or Discounted Cash Flow, method.

6. Review. Once you have this information before you, use your drafted statements to decide how different scenarios may play out.

Define Your Unique Selling Proposition

What is a unique selling proposition?

A unique selling proposition (USP) is the one thing that makes your business better than the competition. It’s a specific and clear benefit that makes your business stand out when compared to other businesses in your market.

Forming an opinionated and deliberate USP helps focus your marketing strategy and influences messaging, branding, copywriting, and other marketing decisions, and influences prospective customers. At its core, a USP should quickly answer a potential customer’s most immediate question when they encounter your brand:

“What makes you different from the competition?”

Your USP plays to your strengths and should be based on what makes your brand or product uniquely valuable to your customers. Being “unique” is rarely a strong USP in itself. You have to differentiate around some aspect your target audience cares about, otherwise your messaging won’t be nearly as effective.

A compelling USP should be:

- Assertive, but defensible: A specific position that forces you to make a case against competing products is more memorable than a generic stance, like “We sell high-quality products.”

- Focused on what your customers value: “Unique” won’t count for much if it’s not something your target customers truly care about.

- More than a slogan: While a slogan is one way your USP can be communicated, it’s also something that you can embody in other areas of your business, from your return policy to your supply chain. You should be able to talk the talk and walk the walk.

Determine Tool Stack

1. Audit Your Existing Tech-Stack

Once you know the basics of what a tech-stack is, you can conduct an audit of your existing tech-stack. Create an audit worksheet listing the tools you are currently using, their intended purpose, and if you want you can even add a column for the cost of the app subscription. Your goal is to take a hard look at the tools you use before adding new ones to your team’s workflow.

2. Identify Gaps in Your Current Tech-Stack

With your audit worksheet in hand, look for gaps that stand out. This is the first draft and early stage of the assessment to get a feel for where your tools are lacking. A good example is whether you are using an SEO tool. Maybe you need a CRM or an automated email app for drip campaigns. How are you managing finances? If you aren’t sure what you’re looking for, don’t sweat it. Just move on to step #3 for the answers.

3. Survey Team Members to Find Out Their Needs and Challenges

No one knows better than your team where your tech-stack is failing. One of the challenges of tech-stacks is that if the wrong tools are used, or you don’t have the tools at all, your team members will have difficulty doing their jobs. Speaking to them is the best way to find out the true issues your current tech-stack poses to your team each day.

Where do they run into trouble? What do they feel could be streamlined? These are important discussions because the purpose of your tech-stack is to resolve challenges. Your team uses the tools every day so have a better understanding of what they need, what works and what causes trouble. However, you also want their input to be purposeful. Each element of the tech-stack needs intent. So, you have to make sure suggestions align with a business-wide process or strategy. You don’t want to waste more money and time.

For instance, if your sales team has trouble prospecting, then purchasing prospecting software would be a natural choice. On the other hand, a team-wide Spotify premium subscription isn’t really attached to a strategy and therefore isn’t really a gap in your stack. It might help improve morale, but it isn’t really a need when it comes to your tech-stack.

4. Have Team Members Brainstorm Software Options and Take Free Trials

You’ll probably find your team has some apps in mind. This makes the job a little easier as you can have them subscribe to the apps to give them a try. For people who don’t have suggestions, have them look into what’s out there based on their needs. They can create a spreadsheet with the features and pricing to help narrow down the right choice.

Ideally, the apps in question will offer free trials so you can test them before committing. As your team tries apps out, they can rate each tool based on performance with top picks, runners up and the ones not worth considering. This helps determine which ones to invest in.

5. Establish A Budget

As mentioned above, you need to consider the investment part of the tech-stack. While it might be nice to invest in the top apps across the board, you need to come up with a budget that is affordable. You can set monthly, quarterly, or yearly budgets, but you can also consider having a budget for each department or function. This allows you to prioritize where the money should go.

Once you crunch the numbers, provide the budget to each team manager so they can use their team’s list of tested apps to find the ones with the best features that align with the budget. If you’re one big team, you can have a meeting to figure out what tools make the most sense for your business.

6. Pilot Your New Tech-Stack Tools

Although you now have a better idea of what you need for your small business marketing apps, your tech-stack is far from finished. Tech-stacks are dynamic because technology is always advancing, and the needs of your business also change. You also need to pilot your new tools to make sure people know how to use them and do a real assessment of each tool’s effectiveness. This process doesn’t happen overnight, but often takes months. Every tool has a purpose that can take seconds or months to assess. A complicated CRM for example has a far more complicated purpose than a grammar checker. The goal is to give the tools time to prove their worth, now and into the future.

7. Measure the Tools’ Business Impact

Once all the tools are put through their paces, it’s time to look at the results. This is easier if you have some goals in mind. What percentage of leads were your sales team reaching before the app and what improvements have they seen using the software? How was social engagement before your new grammar checker, and how is it looking today? What efficiencies are you seeing across the board such as time or money saved?

Perform Legal Check of Business Model and Key Documents

Set up a registered office, place of business and directors

You will need to set up a current registered office that ASIC can use to send documents to the company. Your principal place of business will be the location from which your company operates its business.

You must also inform ASIC of the name, date of birth and current residential address of all directors of the company.

Find out more on our checklist for registering a company.

Company directors must also personally comply with obligations under Australian law. Find out more about company director obligations for small business.

Create and maintain your business name

If the company conducts business using a business name, you must ensure that the business name is registered and renewed when registration expires (every one or three years). We will send the company a business name renewal notice 30 days before the renewal is due.

Find out how to register a business name and renew and maintain your business name.

Update ASIC on key changes

You must notify ASIC of changes to the company’s registered office, principal place of business, directors and business name. You must notify ASIC within 28 days to avoid late fees.

Read more on how to update your company details with ASIC.

Keep financial records

A company must keep up-to-date financial records that correctly record and explain transactions and the company’s financial position. Larger companies have additional obligations to lodge financial reports with ASIC.

Find out more about lodging financial reports and books and records.

Pay fees to ASIC

Fees that companies must pay ASIC include company registration fees, annual review fees, lodgement fees and late fees. Find out more about ASIC fees.

Check annual statements

Each year, we will send your company an annual statement. You will need to check the details on your annual statement, update any changes with ASIC and pay the associated annual company review fee. You must also pass a solvency resolution stating that you have reasonable grounds to believe that the company will be able to pay its debts as and when they become due and payable.

Find out more at Information Sheet 3 Annual statements (INFO 3).

Get professional advice if you need it

Make sure you get trusted professional advice if you are uncertain about your legal obligations.

There are some important questions you should consider before engaging an adviser:

- Is the adviser a member of a professional body and are they subject to a code of conduct?

- Are they regulated by ASIC, the Australian Taxation Office or other government agencies?

- Is the adviser listed on ASIC’s banned and disqualified persons register or have they entered into an enforceable undertaking?

- If I receive bad advice or suspect misconduct, can I lodge a report with a professional body or a regulator?

- Do I need help to better understand my legal obligations and understand how I might be personally liable for my decisions?

- Is the adviser the most suitable to assist with the problem I have? A company director may need to engage separate advisers when seeking advice about the affairs of the company and in respect of their personal affairs.

Define Your Brand

Your brand is the sum of people’s perception of your products, vision, and content. Everything from your voice on social media to your packaging design influences the perception that others have of your brand. Branding can be the difference between customers buying from you or buying from your competitors.

Improving your brand identity begins with understanding your current brand identity. If you don’t exactly know your brand identity, here are seven questions to help you uncover your company’s brand.

Establish an Online Footprint

1. Create a strategy. Far too often, people will hop on to Facebook with no set plan other than, “trying it out.” There’s nothing wrong with trying out any of the many digital channels, but it doesn’t take long to jot down what you want to accomplish (and, more importantly, why you want to accomplish it) first – before filling out any online social networking profiles. If you uncover the strategy after you have already started, you may wind up having a couple of online profiles and spaces that really don’t match your strategy. If someone comes by and sees those initial forays (that you have since abandoned), it might not be the ideal first digital impression of you.

2. Choose the type of content channels and online social networks that match your strategy. All too often we see people on Twitter who would be that much more interesting if they were Blogging. There are people doing things with text that might be better suited for creating images. It’s best to focus on creating and publishing the type of content you are most comfortable with, and that you would enjoy creating the most. The amazing thing about these channels is that anyone can publish. The sad thing is, that some people forget that it’s not just text. You can create audio, video and images as well (and many combinations).

3. Digital Footprint Audit. There are tons of free tools that enable you to listen and see what is being said about you, your company, your products and services. Google News Alerts, Technorati, Twitter Search, and even doing some quick, generic searches on Google, Yahoo and Microsoft can give you the overall temperature of who is saying what. In order to best manage these many tools, you should consider grabbing all of these feeds and unifying them in one singular space. Something like Google Reader or Netvibes is a great place to start.

4. Follow First. Without question, there is somebody (probably many people) already out there using all of these channels. From videos on YouTube to Blogs and Podcasts. Find out who your industry considers to be the top “voices” in the many online channels. Subscribe to their content in your reader and make it a point to read, listen and watch the content at some point everyday. By following those that are already respected, you will be better positioned to see where you can add your voice – both in their environments and on your own.

5. Add your voice. In a world where everyone can (and should) publish their thoughts, you might find it more interesting to either become a frequent commentator on the more popular spaces, or offer to become a contributor to some of the many multi-authored places online (this includes things like industry association Blogs or trade-specific publications). By adding your voice in places that are highly trafficked you can build your presence (and Google Juice) without the stress of maintaining your own. Places like The Huffington Post are prime example of non-industry specific online outlets that are highly trafficked, highly indexed by the search engines and will give you incredible visibility to new people.

6. Start your own, but have a plan. Your overall strategy (step number one) will become your lighthouse. As you fall deeper down the rabbit hole, you’ll always be able to fall back on your strategy to ensure that you are on course, but once you choose to publish your own thoughts on your own platform, you might have an easier time if you create some kind of plan to get started. Think about what goals you want your channel to accomplish, how often you will need to publish, how you will tweak the content as your community grows and what will happen if you were to stop publishing? A plan (even one that includes specific dates for when you should publish content) will help you focus, and it will also get you in the habit of contributing and publishing.

7. Stay active and aware. It’s not just about your space, and it’s not just about following and commenting in the other spaces. It’s about being aware. From Twitter to FriendFeed, there are many new types of publishing platforms being created all of the time. It’s easy to sign-up for all of them and then to forget about them. Some of the channels may not even make any sense to you at the beginning (how many people do you know that still don’t understand what Twitter is, or why anyone would care about that type of content?). It’s also easy to forget about some of the channels that are not mentioned as frequently as the ones that are currently the topic du jour. Be aware of the new and older voices and platforms that are around and the new ones that are coming out.

8. Have fun. One of the primary reasons why people abandon either their own spaces or the ones they used to actively contribute to is because they were no longer having fun with it. It became a job. The trick is to always turn your job into work that you are passionate about. If you start out with the notion that you have to create, comment and participate because it’s your job and that is what is expected of you, it’s going to get ugly fast. There are so many channels out there. Find the ones you really enjoy and create the type of content that gives you the most pleasure. Find your muse.

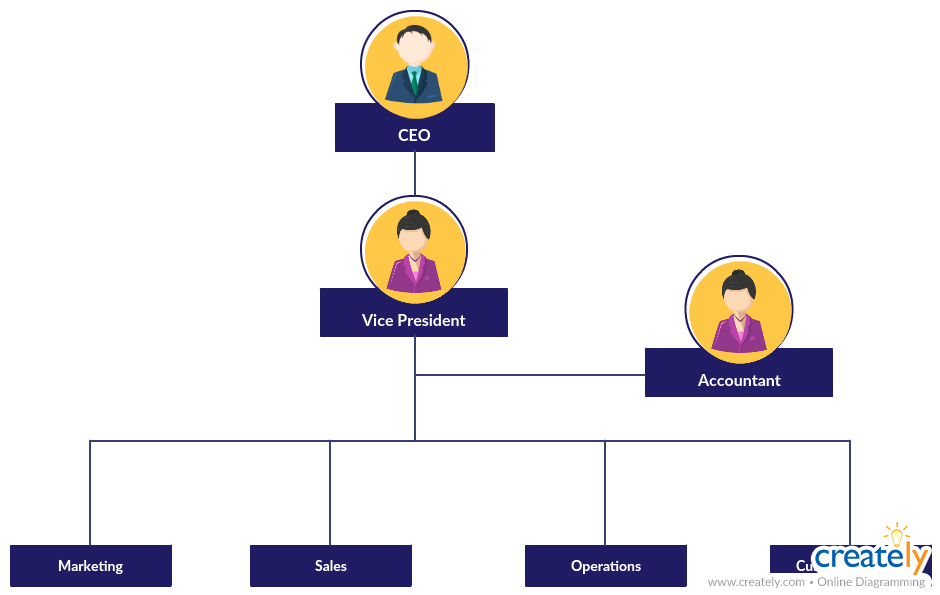

Define Target Organization Chart

An organization chart is a graphical representation of relationships between an organization’s departments, functions, and people. It can also indicate the flow of data, responsibility, and reporting from bottom-up or top-down. Its usage across the globe is a testament to its effectiveness. Below are some rules for drawing organizational charts and org chart best practices to make your org chart more meaningful and useful.

Divide and Conquer

Unless you’re a small company with few employees, organizational charts are definitely going to be complex, with possibly many inter-relationships among departments or functions.

For example, a multinational company may have their subsidiaries in different countries/markets that will have a variety of organization structures (depending on market situation and work functions) and the company will have a huge and complex organizational structure.

When your organization chart becomes too large and complex like the one above, it can be split into smaller charts. You can split it by department, project, site, region, etc.

Whatever it is that makes sense to others in your organization. This makes it easier for the viewer to understand the responsibilities or the expectations of each department.

Breaking down the org chart into small charts makes it becomes much easier to monitor the progress or workload of employees. So that it can be easier to spread work among workers with less load. It also makes it very easier to do a comparative analysis of a situation so that resource allocation can be streamlined to meet the demands of different situations.

Org Chart Software

There are many org chart software available both online and offline that facilitate the creation of various types of organization charts.

When large organizations have multiple organization charts covering their sub-units it is likely to be difficult to study them together at a glance.

With a chart covering several pages it can also be confusing working out the connections between each entity shown in the chart. With Creately as your organization chart diagramming tool, you can avoid this issue using the diagram linking feature. This allows viewers of the chart to see the connections between charts, navigate between the different charts and possibly like to individual employee profiles.

For example, take a look at the below org chart. It shows the top hierarchy of the company. Now click on the highlighted box (the blue right-hand CEO box) and it will take you down to another org chart that further breaks down that department. You can quickly move back to the original chart by clicking the arrow buttons in the bottom toolbar. Go ahead and try it yourself.

Make Sensible Groupings

When organization charts are being broken down into sub-charts, sensible grouping and linking is a must since the connection of each chart and the flow should be easily understandable to the viewer.

Sensible grouping is done based on how individuals, jobs, functions or activities are differentiated and aggregated. The information flow also requires optimizing within each group but at the same time clearly differentiating it from the other groups.

Structural Linking

Structural linking of the groups should be performed with an integration mechanism (eg: liaison roles, cross-unit groups, integrator roles or projects and dotted lines) to assist with coordinating and sharing of information across groups which will enable the organizations leadership to provide guidance and direction throughout the organization.

Set Up Business Bank Account

What you will need to set up a business bank account will vary depending on the bank and your business type. Documents and information you will need to provide may include:

- business name

- primary business address

- Australian Business Number (ABN)

- industry type

- identification for all owners or partners.

Set Up Accounting

1. Open up a bank account for your business

Before you choose and set up accounting software, you should think about opening up a separate business bank account. Some business structures must open a separate bank account (e.g., LLC, corporation, or limited partnership). Keep a separate account for your business to:

- Avoid spending your personal money on business needs

- Easily organize your records

- Forecast cash flow

- Make filing your business tax return easier

2. Select an accounting method

There are three accounting methods to choose from: Cash-basis, modified cash-basis, and accrual accounting.

Cash basis is the simplest method of accounting. Cash-basis accounting uses the single-entry method of accounting. With single-entry, you record each transaction as one entry as they happen. This accounting method is best for short-term transactions.

Modified cash-basis accounting is a happy medium between cash-basis and accrual accounting. Modified cash-basis uses the double-entry method of accounting. You can use cash-basis for short-term transactions and accrual accounting for long-term items such as long-term liabilities and accounts payable. In other words, you record transactions when money changes hands, and even when it hasn’t yet.

Accrual accounting can feel complicated to a beginner. Accrual uses the double-entry method of accounting. With accrual accounting, you record transactions when they take place, regardless of whether you’ve received any money yet. This is the best method to track funds over long periods.

3. Choose accounting software that fits your needs

First, you need to know how to choose the right accounting software for your business. After all, there are plenty of options to consider. So many in fact, it can feel a bit overwhelming. But, it’s easier than you think.

Before you choose software, let’s cover the basics. There are two types of accounting software to choose from: Cloud accounting and desktop software. Cloud accounting allows you to work from wherever you are, while desktop software generally keeps you tethered to the single computer or device you downloaded your software to.

Whichever type of accounting software you choose, there are a few other considerations you need to keep in mind. Make sure that your accounting software:

- Has payment options that fit your budget

- Is one that you know how to use

- Includes the features you need

- Offers flexibility and can change as your needs change

- Provides customer support that is there when you need it

Try Patriot’s award-winning accounting software!

- Easy onboarding with startup wizard

- Simple Chart of Accounts setup

- Patented Dual-Ledger Accounting

4. Set up a chart of accounts

A chart of accounts (COA) is a way to keep track of all your business accounts. Think of it like a table of contents, it helps you understand all of your accounts at a glimpse. Your COA will break down your business transactions into five main accounts with as many sub-accounts as you need.

Here’s an example of how your five main accounts and sub-account could look:

- Asset

- Checking

- Savings

- Petty cash

- Account receivable

- Liability

- Accounts payable

- Sales tax collected

- Payroll tax liability

- Equity

- Owner’s equity

- Income (revenue)

- Bank account interest

- Product sales

- Miscellaneous income

- Expense

- Advertising

- Equipment

- Insurance

- Supplies

- Payroll expense

5. Decide how to organize new transactions and old records

The IRS suggests that you keep detailed records of purchases, expenses, and assets, plus anything you want to deduct. Common sense demands it. If you’re looking for accounting software (and we know you are) consider organizing receipts electronically. When organized correctly, electronic receipts can make bookkeeping easier.

Whether you’re using electronic receipts or sticking to hardcopies, the same guidelines for organizing business receipts apply. Some general guidelines for organizing receipts include:

- Sorting receipts by type

- Organizing receipts chronologically

- Setting aside a specific place to store the receipts (e.g., a filing cabinet or a digital folder)

- Being consistent

6. Choose a start date to switch to your new software

A good time to make the switch is the end of an accounting period because you can use the closing balances from the last period as beginning balances. If you use 13-month accounting periods, the end of an accounting period will arrive quickly.

And since we are talking about schedules … if you want to keep things simple, make a schedule for bookkeeping tasks and set reminders so you don’t forget.

7. Plug in the numbers

You’re now ready to use your accounting software and get back to business. Stay organized, stay on time, and plug in the numbers. It’s as simple as that.

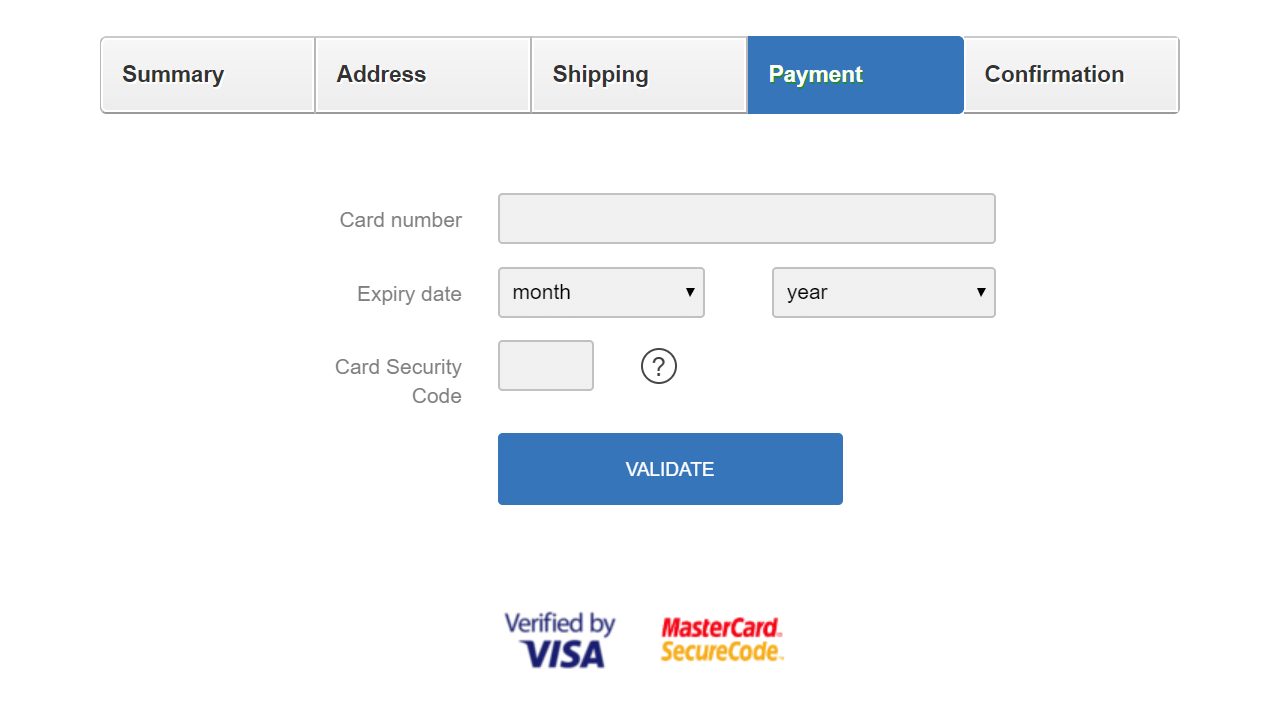

Select Payment Service Provider

Based on our experience working with many PSPs, we recommend 5 criteria for choosing a payment service provider.

1. The popularity of payment service providers

You should ensure that your chosen PSP is available to all stakeholders who want to have access to the system. In Europe and especially Germany, direct debit, bank transfer, Mastercard, VISA credit card, and payments via Paypal are available. Debit cards, e-wallets like Skrill, prepaid cards like paysafecard, mobile payments on platforms like mpass are also sometimes available.

1.1. International payments

Global retailers will need to break down and research to select different payment processor PSPs in different countries.

The major number of overseas transactions can’t be completed by eCommerce retailers because the payment methods aren’t available in some countries. Therefore, choosing the right payment service providers will help your website go global.

For example, if you want to open a website in Sweden, you need to adopt Swish, which more than 75% of residents use for their online transactions. Or else, you could lose a large portion of your potential sales.

1.2. Mobile payment offers

With the increasing number of mobile device users, customer behavior tends to change respectively. Consumers expect uncomplicated and efficient online shopping platforms that they can use on the go. Online businesses can increase conversion rates by enhancing the mobile user experience.

- Some PSPs offer checkout features, in which you can tailor the checkout process for each type of mobile device. This provides mobile optimization for the retailer’s website and provides a high level of brand recognition.

- Mobile payment behaviors such as QR code or SMS payments by PSP are also reasonable and useful for an omnichannel strategy for integrated shopping and targeting some customer groups.

2. Technical requirements of payment service providers

You should choose a third-party service provider that offers modules that can integrate with your existing software and business processes. In some cases, integrating in-house development with the existing store system can be difficult when looking beyond the ERP interface. Thus, your selected PSP should offer modern and popular integration options including:

- API connections for further integration

- Redirects (or forwarding) to forward customers from the retailer’s website to the secure website of the PSP after the checkout process is complete.

- iFrame and iFrame connections to adapt a new layout and page for a secure checkout formula from PSP and transfer payment data at higher security

3. Payment development security

PSPs are independent of the bank so they will need a BaFin certificate. This certificate is issued and certified by major European financial supervisory authorities to:

- Allow PSPs to set up escrow accounts to accept payments at banks across Europe

- Protect PSPs transactions in the countries where they have an established escrow account and in Germany

In addition, PSP must meet worldwide data security standards like Payment Card Industry Data Security Standard (PCI DSS) to offer credit card payments. By having that, PSP can:

- Ensure customer credit card data is protected from theft or fraud

- Save eCommerce retailers a lot of time attempting to obtain this certification yourself (since your chosen PSPs are already certified)

4. Services provided by PSPs

PSPs offer different services among different providers. Therefore, retailers should have a clear outline of what services are necessary and important to the growth of their online stores. For example, new and growing retailers need to address topics such as market and expansion. Below are suggestions for popular services that retailers can refer to:

4.1. Subscriptions and recurring payments

Some PSPs offer recurring payment processing services. This feature is essential for businesses in industries like media and food, in which their customers can:

- Access their payment status in a real-time overview

- Save and retrieve payment data when they want to make repeat purchases

Subscription models should have other available payment methods besides the popular credit cards such as direct debit or PayPal. This ensures a fast and enjoyable reordering experience for customers.

4.2. Support services

The difference in support level can be huge according to cost, language, and scope. Most retailers expect not only guidelines but also a direct support line for in-store incidents. Customer support is extremely important to certain customers and industries. You should consider this aspect in your full service contract with payment service providers.

4.3. Risk protection from missing payments

Online merchants often face a rather higher risk of not receiving or losing payments from customers. High payment rejection rates can lead to reduced profits. You’ll have to pay additional costs by 3–4.5% of direct debit payments for collections and warnings. Most PSPs can provide risk protection services to save you these additional charges.

- You can add additional fraud prevention modules supplied by PSPs to your eCommerce websites. From there, PSP monitors payment issues in the store such as chargebacks or declined payments. Then the PSP can recommend tweaks to their program to better protect the business.

- PSP also offers a customer blacklist check service for stores, even by credits and addresses.

4.4. Further service offers

In addition to the main services mentioned above, some certain payment solution providers may offer many other services based on:

- The transaction volume of the store

- The information that the receivables management department shares with the suppliers

- The payment behavior of the target group

From there, PSP will receive notices to monitor payments, debt collection, and then invoice or refer to a collection agency if necessary. Some service providers also offer factoring and financial services, currency conversion management, and business accounts.

5. Contracts and pricing for payment service providers

Pricing and collaborative contracts between your online store and PSP are an important part of the selection process.

The typical cost model consists of variable and fixed fees. A certain one-time setup fee and a predetermined monthly cost can be as low as €500.

- The variable cost depends on the number of transactions in the online store and the expected sales revenue. PSP typically accounts for 1.5–3% of a store’s sales, which can fluctuate and peak at 9%.

- Other fees are currency conversion rates and transaction cancellation fees.

- For small transaction volumes, some PSPs charge a certain flat fee for each transaction.

Basically, the longer the contract and the larger the sales, the cheaper the cost.

Institute Sales Funnel

A sales funnel is a visual representation of the journey from your prospect’s first contact with you until a completed purchase. It helps your sales team understand where they need to follow up or alter the sales process due to drop off in the funnel.

The sales funnel definition prescribes that it literally acts like a funnel, meaning it is widest at the top and narrowest at its the bottom. Each stage of the funnel pushes your qualified prospects into the next stage and drops those that are not a fit for what you offer.

A sales funnel is directly connected to the customer journey phases, which can be sorted into three parts: top, middle, and bottom.

The sales funnel structure shows the process that prospects go through: Untouched > Contact made (Leads) > Qualified > Proposal presented > Negotiation > Won.

Studying your sales funnel can help you understand where you’re going wrong with prospecting, exactly where leads drop off and what led existing customers to follow the sales funnel all the way through. Optimizing your sales funnel can have an immediate, lasting impact on your sales goals.

Top-performing sales reps know the steps of their sales funnel inside out, from cold calling to finalizing the sale. This helps them in two key ways:

They can address customer’s key needs and deliver the right message at the right time;

They can scale their sales process and forecast their sales and revenue to hit their goals.

In other words, a well-defined sales funnel improves the customer’s journey as well as the company’s performance.

Prepare Cross-Channel Marketing and Sales Strategy

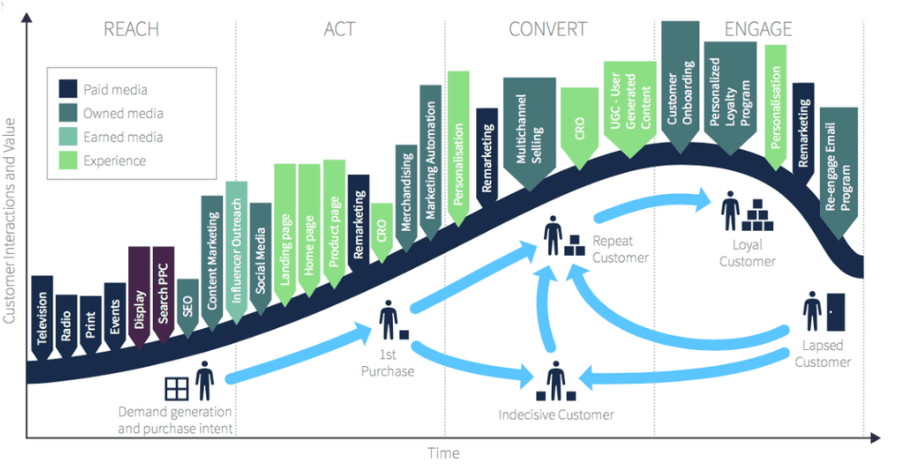

Cross-channel marketing is a customer-focused digital marketing technique used by marketers globally to provide an integrated experience across all paid, owned, earned media, and digital experiences.

It is a powerful way of designing your marketing strategy and implementing data and analysis to create omnichannel customer journeys towards your goals.

Implementing a cross-channel marketing strategy can be a little intimidating. You need to take care of multiple channels while designing your campaigns.

Keeping track of every campaign and integrating their analytics is certainly not an easy task. That’s where our RACE Framework comes in.

Set Up Customer Care

Great customer service is an expectation, rather than an added benefit. Consider some of these statistics:

- Customer service contributes to higher customer retention, which directly impacts your bottom line. Just a 5% increase in customer retention can lead to a 25% increase in profit.

- 96% of customers say customer service is an important factor in their loyalty to a brand.

- Great customer support also boosts your marketing: 72% of customers will share a positive experience with six or more people, helping you reach new customers.

- 67% of customers say they would pay more for a better customer service experience.

Customer service and support impact everything from marketing to customer acquisition and retention to profit. Therefore, it’s worthwhile spending the time to build an excellent customer service support team.

Implement Reputation Management

Let’s go over a sample reputation management plan that you can adapt to fit your business needs. It’s essential to keep in mind that reputation management is a continuous process, so neither step is one-and-done; they should be consistent as long as your business is up and running.

1. Research and audit.

The first step to reputation management is research. During this phase, you’ll use the internet to discover conversations about your business and what people are saying about you. Aim to seek out all different types of conversations, as all feedback is helpful for understanding perceptions and improving your reputation.

You can conduct this audit from your customer reviews, on review sites, on social media, and by simply searching for your business’s name on Google and various search engines. You can also search for business-relevant keywords or even the feeds of your competitors. Consumers are talking; you just have to meet them where they already are.

As there are many different platforms and websites you’ll use to conduct your research, using a high-quality reputation management tool will make the process easier, and we’ll recommend some below.

2. Establish a management strategy.

Once you know what overall perception is of your brand, you’ll know where you’ll need to focus to improve it. For example, suppose your audit shows that the conversation around your brand is unfavorable. In that case, you will want to employ practices that will help you improve the experiences that people have with your business.

As such, the next step is to create a consistent management strategy. Regardless of what your current standing is, your plans should address the following:

- Who will consistently monitor online conversations?

Designate specific people at your business to be in charge of conducting continuous research and monitoring conversations about your business online. Those already on customer-facing teams are likely the most equipped to deal with customers, like those on marketing or customer service teams.

Either way, those who monitor online conversation and respond to comments should have experience doing so, and understand how to speak with customers.

- How do you decide which comments, reviews, or mentions need responses?

Some people’s only intent is to troll rather than speak about legitimate experiences. These comments and conversations are fake, created on purpose to diminish your reputation. Most comments, however, are based on real interactions, experiences, and thoughts about your brand, both positive and negative.

You should never respond to reviews that seem fake (here’s a guide on spotting and removing them from Google). However, you should respond to comments from real consumers, which is why it’s essential to understand which warrant a response.

It’s not possible to respond to all of them, so maybe you prioritize responding to customer questions or create specific requirements that dictate when a response is necessary, both for positive and negative comments.

- A tone guide for responding to comments.

Responding to comments and conversations about your brand is not worth it if you don’t have a consistent tone of voice that you follow. For example, if you respond to criticism harshly but positive comments with returned positivity, it will do more harm than good.

Develop a standard tone guide that you will use when responding, and aim to stick to it. It can also be helpful to have a crisis management plan in place within your reputation plan to take action during situations that escalate quickly, are difficult to control, and may leave responsible parties frantic and not adhering to standard guidelines.

3. Take action based on comments, feedback, and reviews.

Understanding how consumers view your brand is the most valuable tool for improvement and innovation. Their criticisms and pain points will direct you to areas of your business that need increased attention, and their positive comments let you know what you’re doing right and what you should continue doing.

As you’re hoping to manage your reputation, taking action based on comments, feedback, and reviews helps you manage your reputation as you’re making changes that customers want to see.

4. Continuously practice steps one, two, and three.

As mentioned above, managing your online reputation is a continuous effort. Although it may be nice, rectifying one situation doesn’t mean that everything is smooth sailing from now until forever.

Always research and monitor conversations about your business to get a sense of where your reputation stands, follow the steps of your plan, and act on the feedback you receive.

Let’s go over some high-quality tools you can use to supplement your reputation management process.

Prepare Tech Infrastructure and Security

Maintaining Your Infrastructure

One of the easiest mistakes you could make as a business is to just ‘set and forget’ your IT infrastructure. Chances are that when you started your business, or set up your current location; you put a lot of thought and work into the server build and network configuration. But have you put much time or thought into these elements since then?

There are some key tasks you should be performing periodically on the elements of your IT infrastructure. Regular maintenance ensures optimal ongoing performance and maintenance. Now, whether you choose to perform these tasks yourself, or hire outsourced IT services; that’s completely up to you! The most important thing is that someone is performing these maintenance jobs; in order to keep your business operating smoothly.

1. Auditing

In the wonderful world of IT, auditing is absolutely something you should not be wary of. In the context of business, audit is often a scary word associated with taxes and the looming threat of fines. But when we talk about auditing in IT, the primary role of this task is to identify security vulnerabilities, and to highlight problem areas of efficiency and compliance. In short, an IT audit is an excellent way to ensure that your IT infrastructure is operating as it should be, and also to offer potential solutions for further optimisation.

A comprehensive IT infrastructure audit will take a look at all your hardware devices and network structure to ensure that your equipment is sufficient for their assigned tasks (i.e. your server device isn’t sluggish and overheating from being underpowered). They will identify any opportunities to improve performance within your hardware or network devices.

The singular ‘downside’ to this process is that it does require specialised knowledge or experience. Which, unfortunately, many business owners are unlikely to have. This means you would need to outsource the process to an IT service provider. On the upside, however, you only really need to get an audit performed once a year, or every two years.

2. Updates

This maintenance process applies more specifically to the software category of your IT infrastructure. This is absolutely something that you can take care of internally without requiring an external IT service provider. It can become tedious or time-consuming when you have multiple software tools and platforms all operating on different update schedules, so for that reason alone, you may still want to consider outsourcing the process.

However, updates are periodically rolled out for software in order to patch security vulnerabilities, to fix buggy coding (which may be affecting performance) and also to roll out new features; which frequently enable more efficient work processes.

Your hardware devices may sometimes require driver updates or patches as well; these are absolutely crucial in terms of maintaining your infrastructure. While software updates can range in importance (from security to a harmless glitch), hardware updates are usually less frequent and incur much more important additions to the performance and function of the device.

3. Backups

Backups are an essential component of IT infrastructure maintenance. Overall, maintaining your IT infrastructure is your significant contribution to your business continuity. So, in terms of ensuring business continuity, and overall maintenance of your infrastructure; backups are where its at.

Your system should have a backup protocol set to a regular schedule. This backup protocol should cover all aspects of your backup: timing and scheduling, your backup server (and associated maintenance), monitoring backup notifications, as well as periodic testing of your backups. There could be nothing worse than requiring your backups after a catastrophic failure, and finding out that the last six months of backups are corrupted or otherwise absent.

On the same note as backups and business continuity; ensure that you do have disaster recovery steps in place as well. This should form part of your business continuity plan. Your business continuity strategy covers questions such as what to do with your network in the event of an attack? Do you need to remove user access? Who do you need to notify? When these steps are all laid out in a relevant business continuity plan, you don’t freeze in the moment when it matters. With many cyber incidents, prompt action can be the difference between recovery and disaster.

4. Review, Upgrade & Streamline

As we briefly discussed earlier, your IT infrastructure is composed of your hardware, your software, and your network. These components, for the most part, should not be considered as ‘set and forget’ parts of your business. Just as you’re probably not still using an iPhone 3G, because you’ve gradually upgraded, it’s important that you should also look at doing the same with your infrastructure.

To use the phone analogy, this doesn’t mean you upgrade your phone every 6 months. Though admittedly, some people upgrade with every new model release. For the most part though, people will use the same phone for a couple of years. Then after a while, it becomes apparent that the phone is no longer keeping up with the required functions and they upgrade. Consider your infrastructure in the same way. What was appropriate for your business two years ago may no longer work for you.

Internet connectivity can often use a refresh, and your server may require cleaning up, or it could be approaching free disk space thresholds. Continual maintenance and appropriate upgrades means that your IT infrastructure is more efficient, and ultimately, lasts longer.

5. Security

Security upkeep and maintenance is a huge part of your IT infrastructure. Your network, your firewall, your server access, end-user devices, emails, etc. These are all subject to potential cyber attack, or infiltration and have the potential to completely collapse your whole system.

Security maintenance and upkeep within the context of your IT infrastructure covers a few things. Namely, your cyber security protocols, your security tools, network monitoring, and security testing.

We recommend every business should perform periodic self-evaluations in terms of cyber security. Don’t feel daunted by the prospect, it’s pretty simple and straightforward. To start, have a read of our cyber security checklist which gets you to review if you have existing cyber security protocols, two-factor authentication, data encryption; and so on. If you have an internal IT manager, they should be able to easily answer these questions for you. If not, these things are fairly straightforward to determine yourself. After completing this checklist, from there you can go on to update, review, and revise your security protocols as required.

Define Top 20 KPIs

The most systematic way to accomplish that is to set up and measure KPIs that will display all of your financial metrics. In this post, we’ll outline 20 of the most important financial KPIs for business that you should evaluate for your company.

1. Working Capital

Your working capital measures your accessible assets that meet the company’s short-range financial commitments. This includes obtainable cash, short-term investments, and receivable accounts that demonstrate how your business generates cash.

Working capital is the difference between a company’s current assets, like cash, accounts receivable (customers’ unpaid bills) and raw materials and finished goods, and current liabilities, like accounts payable.

Working Capital = Current Assets – Current Liabilities

This is the measurement of the operational effectiveness of your business. The working capital ratio (current assets/current liabilities) indicates whether your company has sufficient short-term assets to cover a short-term debt. A solid working capital has a ratio between 1.2. and 2.0. Everything below 1.0 is considered a negative working capital. A ratio of over 2.0 could mean that you aren’t maximizing your excess assets to generate maximum revenue.

2. Operating Cash Flow

Operating cash flow is the calculation of the total cash that is produced from business operations. This signals whether your company can make enough cash flow to keep operations in place or you need to ask for more funding to supplement your capital.

Operating Cash Flow (OCF) = Operating Income (revenue – cost of sales) + Depreciation – Taxes +/- Change in Working Capital

In essence, this is the cash version of your net income. The operating cash flow is focused on inflows and outflows that are connected to your central business activities, such as sales, buying office inventory, services and salaries. Your investments and other financial transactions are not considered as part of your operating cash flow because they’re noted as separate transactions, such as borrowing, buying capital and dividend payments.

3. Current Ratio

Your current ratio is a financial KPI for business that is used to evaluate your firm’s short-term liquidity. It indicates the business’s capacity to generate enough to pay any debts if they were to all come due at once. The two main parts of the current ratio are current assets and current liabilities. Your current assets are anything that can be turned into cash inside one business year (cash equivalents, accounts receivable, marketable securities, inventory, and prepaid expenses).

Current Ratio = Current Assets / Current Liabilities

Current liabilities are your debts and obligation inside one business year that can be listed on your balance sheet (short-term debts, account payables, acquired liabilities).

4. Return on Investment (ROI)

Return on investment (ROI) measures the winnings or losses created by an investment relative to the money that you invest. Your ROI usually appears as a percentage and is used to compare to your company’s profitability or the efficiency of your various investments.

ROI = (Net Profit / Cost of Investment) x 100

Because of its flexibility and simplicity as a ratio, it is one of the most used financial KPIs in business. The calculation is straightforward, fairly easy to explain, and has many applications. If your ROI is positive, or if other opportunities with higher ROIs are available, those can help you remove or choose the best investment options for your company.

5. Return on Equity (ROE)

Return on equity is the quantity of net income that is returned as a ratio of the shareholders’ equity. This calculates your company’s profitability by disclosing your generated profit with the money invested by shareholders.

Return on Equity = Net Income/Shareholders Equity

ROE is helpful if you want to compare the profitability of your business with your competitors. It indicates how you turn the money that is invested in your business into profits for your company, and as well for your investors. The bigger the return on equity, the more efficient your business is.

6. Return on Assets (ROA)

The return on assets indicates how profitable your company is compared to your total assets. This will give you insight into how effective your management is at generating profit. The ROA is calculated as a percentage.

ROA = Net Income / Total Assets

ROA will let you know how much you earned from your invested capital. For public companies, the ROA can be different and it depends on the niche that the business is in. The higher the ROA the better, because you make more profit with fewer investments.

7. Gross Profit Margin

This is among the financial KPIs for business that can be used to measure your firm’s financial status and business model by uncovering the amount of money that remained from revenues after the accounting process for the cost of goods that are sold (COGS) is conducted.

Gross Profit Margin = Revenue – COGS / Revenue

When you analyze the gross profit margin, you can tell if your company has created a product that is better than your competitors.

Your gross profit margin needs to be stable because, without the right gross margin, your business will not be able to cover its operational expenses.

If the gross margin can vary because of industry shifts or new pricing strategies, the regulation can be changed. If you sell a premium product for a premium price compared to competitors that sell a basic product at a normal price, you’ll have a high gross profit margin.

8. Net Profit Margin

This is the percentage of net profits to revenues for your company segments. This shows how much of the money that you’ve collected as revenue is actually profit.

Net Margin = Net Profit/Revenue

Net margins can be different, depending on the business size and industry. For example, as an individual writer you’ll have a small overhead and as a result, your paycheck will be constantly profitable. But, the annual profits and net margins of a freelance writer can seem really low compared to corporations such as Costco or Whole Foods.

The net profit margin can be one of the vital KPIs that shows how strong is your business. By following if your net margin increases or decreases, you can estimate if how you run your business works for your growth or not. You can also use your net profit to further predict profits that are based on your revenues.

9. Sales Growth

Sales growth is a metric that measures the ability of your sales team to increase revenue over a fixed period of time. This is one of the most crucial financial KPIs for business because as a leader, you need to be able to make projections for the growth of your organization. You need to monitor this metric on a weekly or monthly basis to see if you have a steady growth trend or not.

As a business owner, you’ll want to know how your sales team performs, and sales growth provides you with all the data.

10. Acid Test Ratio

Your acid test ratio is a powerful measurement if you have enough short-term assets to cover rapid liabilities. This KPI is stronger than the current ratio (working capital ratio) because it brushes aside assets that are not liquid (inventory).

Acid Test Ratio = (Cash + Accounts Receivable + Short-term Investments)/Current Liabilities

The main purpose of the acid test ratio is to get a realistic point of view about your firm’s liquid assets (cash, cash equivalents, short-term investments). If your company has an acid ratio that is less than zero, you don’t have a sufficient amount of assets to pay off current liabilities. If your acid ratio is smaller than your current ratio, it means that your current assets depend mostly on your inventory.

11. Debt-to-Equity Ratio

The debt-to-equity ratio presents the amount of equity and debt that your firm uses to finance its assets, and how much the shareholder’s equity can meet obligations to creditors if your business is in a downturn.

Debt to Equity Ratio = Total Liabilities / Total Shareholders’ equity

A lower debt-to-equity ratio indicates a lower amount of financing debt via lenders versus funding through equity via shareholders. A higher ratio indicates the company is getting more of their financing from borrowing which may pose a risk to the company if debt levels are too high.

The debt-to-equity ratio can help investors estimate if your company is highly leveraged, which may present a higher financial risk. They can compare your company’s debt-to-equity ratio against industry averages and other similar companies to gain insight into the connection between your business’s equity and liability.

12. Accounts Payable Turnover

The accounts payable turnover is a short-term liquidity percentage that can be used to measure the speed at which your company pays off suppliers.

Accounts Payable Turnover = Total Supplier Purchases / Average Accounts Payable

A declining turnover during a given period means that you need more time to pay off suppliers. If the ratio increases, you pay off suppliers at a faster rate than in prior periods. This is also a proof of your company’s financial health.

13. Day Sales Outstanding

DSO is a KPI that measures the average number of days that it takes for your company to accumulate payments after a sale has been made. You can quantify your day sales outstanding on a monthly, quarterly or annual basis.

DSO = Accounts Receivable/Total Credit Sales X Number Of Days

Higher DSO can indicate that your company sells the product to customers on credit and as a result, it takes longer for you to collect the money. This can lead to cash flow problems because of the time between the sale and the time that your company receives payment. A low DSO value means that it takes your business fewer days to collect its accounts receivable.

14. Accounts Receivable Turnover

The accounts receivable turnover is a KPI that helps you gauge the effectiveness of your business in credit extension and collecting credit debts.

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable